Insights

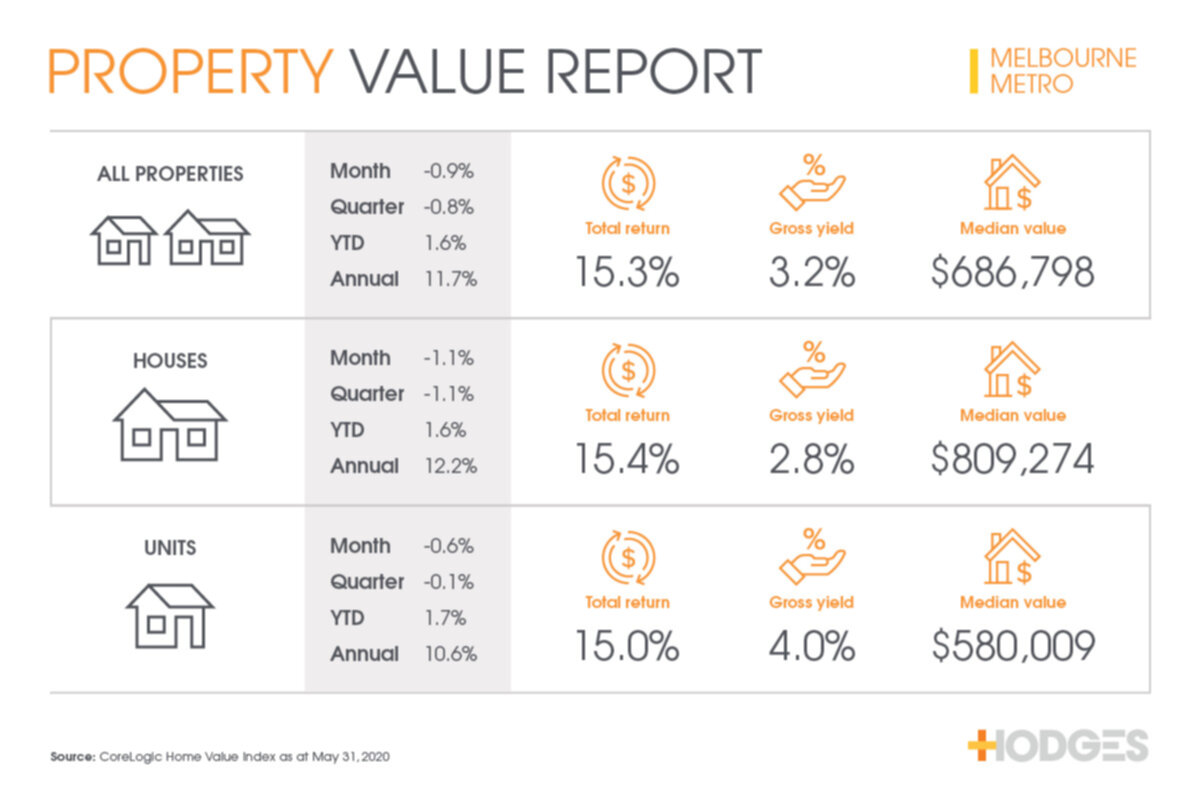

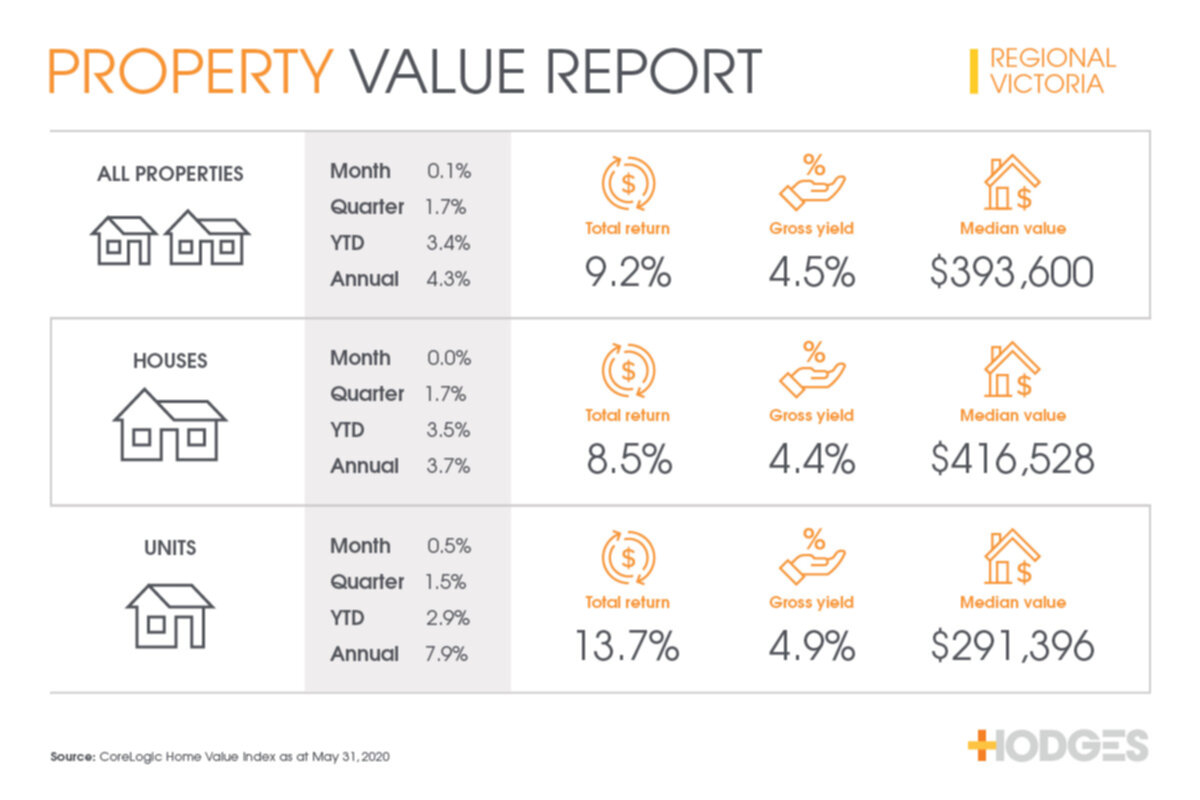

Property Value Report

Despite the perceived doom and gloom we see in the headlines, property prices have in fact remained stable throughout this unprecedented time. Housing values have only just begun to edge lower in May, with Australian dwelling values experiencing their first month-on-month decline since June last year. The national index was slightly down 0.4% over the month, with five of the eight capital city regions recording a fall in values.

As COVID-19 restrictions continue to ease we can only expect life and the property market to normalise further for most Australians. There are many active buyers in the marketplace with search activity for properties hitting a new record, growing a further 0.5%. Search activity for properties for sale is in fact up 38% year-on year and 62% above the low in March.

CoreLogic head of research, Tim Lawless, expressed “Considering the weak economic conditions associated with the pandemic, a fall of less than half a percent in housing values over the month shows the market has remained resilient to a material correction. With restrictive policies being progressively lifted or relaxed, the downwards trajectory of housing values could be milder than first expected.”

Definitions:

YTD – Year to date (YTD) refers to the period commencing the first day of the current calendar year up to the current date and the percentage (%) change from then until now.

Gross Yield – The “yield” of a property tells you how much of an annual return you are likely to get on your investment. It is calculated by expressing a year’s rental income as a percentage of how much the property cost.

Total Return – is calculated from property value change as well as the gross rental yield. Typically, houses have a superior value growth performance while units offer superior rent returns. You can’t simply sum the Gross Yield and Annual Return figures together to calculate the Total Return, as the Total Return is based on an annualised Gross Yield, which differs from the Gross Yield shown in this graphic (month-end figure).