Insights

Property Value Report – August

As the chaos and uncertainty around the global pandemic continues well into the second half of 2020, the effects to the Australian economy remain unclear.

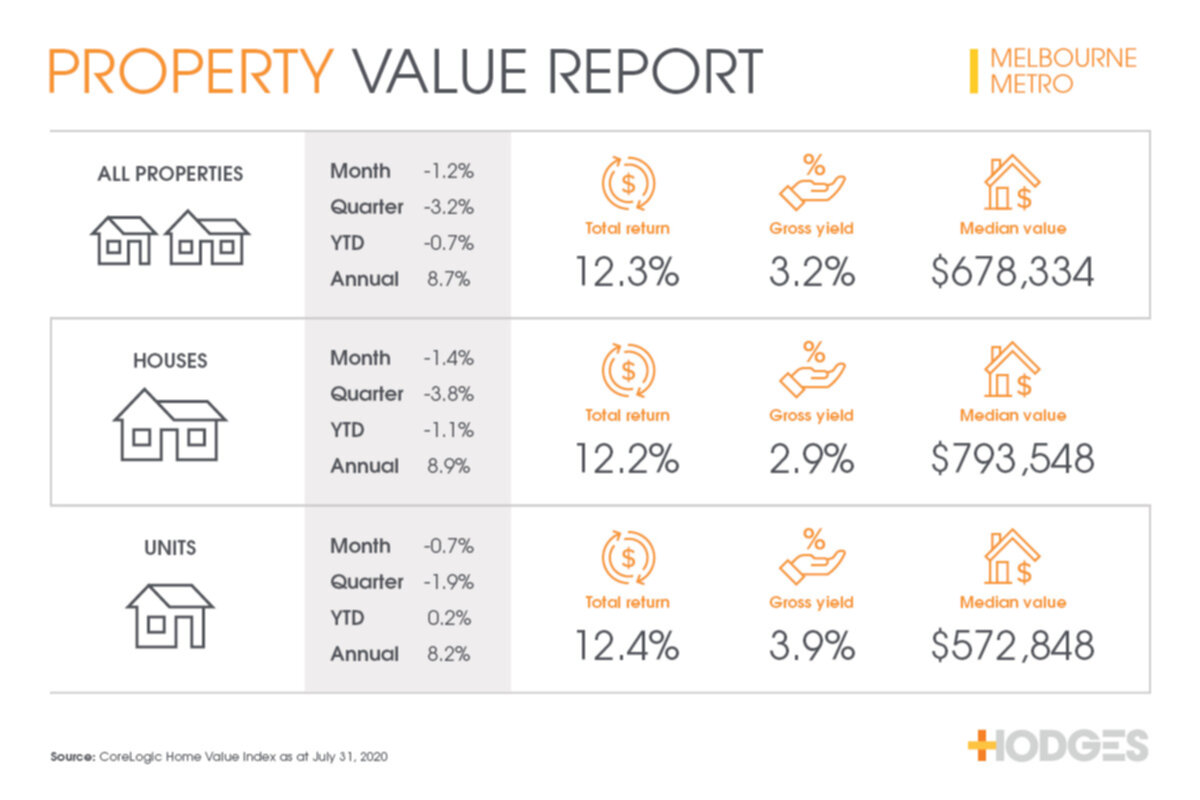

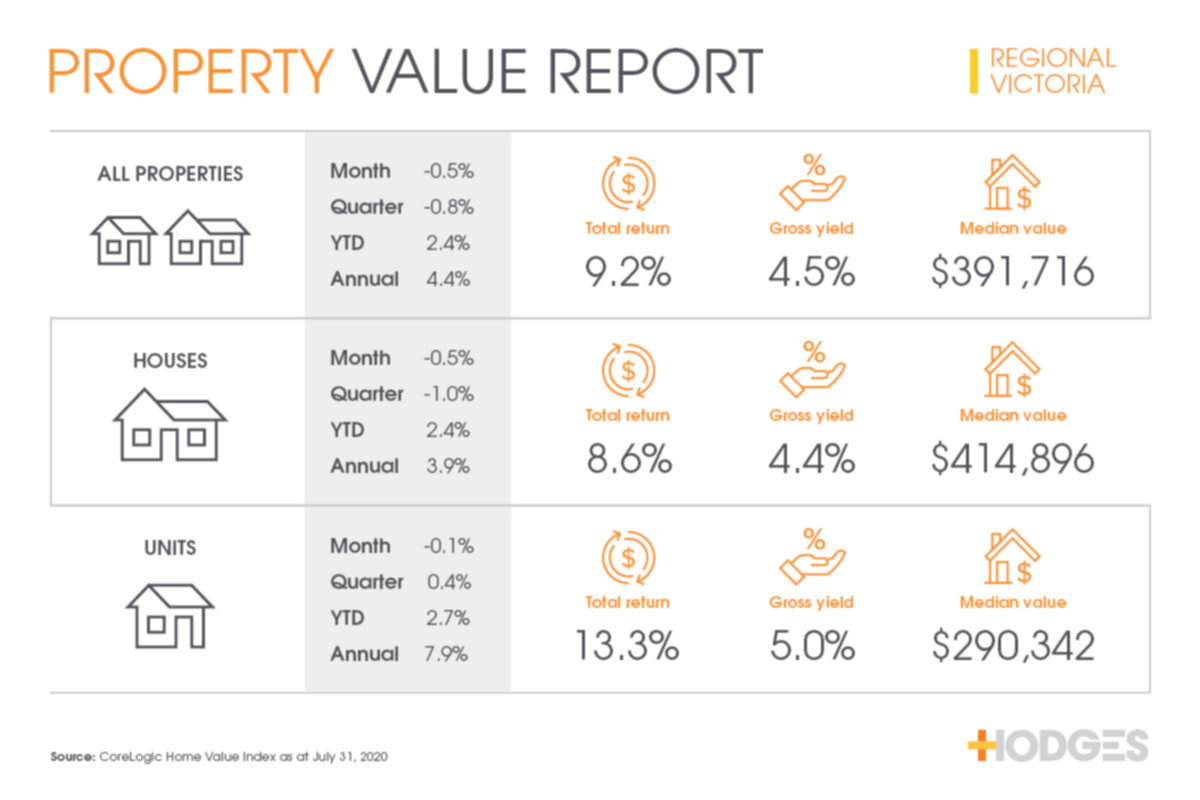

As for the national property market, housing values experienced a third consecutive month of mild decline, dropping 0.6% in July. This is a slight improvement from the previous month where dwelling values fell 0.7% nationwide.

With an array of Government incentives put in place to stimulate the property market, we are actually seeing buyer enquiries surge. This is especially prevalent among the first-home buyers demographic who are able to leverage on the 5% deposit scheme, stamp duty exceptions, record low interest rates and the new HomeBuilder initiative. The housing market has proven to be extremely resilient throughout the COVID-19 period.

We still have a long way to go and the coming months will certainly test the true buoyancy and strength of our nation’s property market. Monetary support is planned to taper from October and repayment freezes are currently scheduled to expire at the end of March next year. In Victoria especially, the rapid emergence of the virus’s second wave and tightening of restrictions will certainly put downward pressure on buyer sentiment. Rental rates have continued to trend lower throughout July, with the unit sector being hit the hardest.

Overall the national housing market has weathered well against extreme economic hardship. The decline in home values has been orderly and systematic. The modest reductions suggest that we are already in a stable position for quick recovery and turnaround for our property market.