Insights

Property Value Report – September

The last few months we have seen a remarkable shift in customer behaviour. With increased time being spent at home, Victorians are devoting significantly more effort to searching for property online. Buyer search enquiries have increased across both realestate.com.au and domain.con.au. This indicates that Victorians remain highly engaged in real estate, and that there are many active buyers in the marketplace.

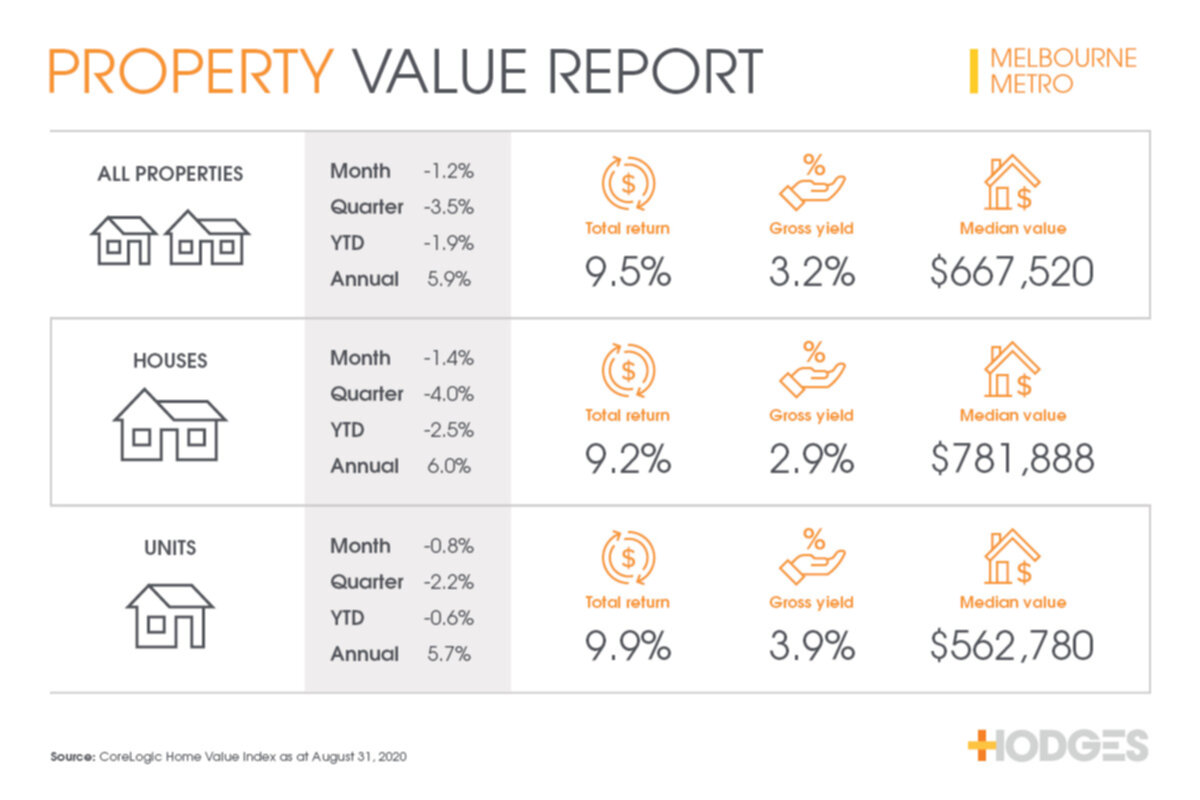

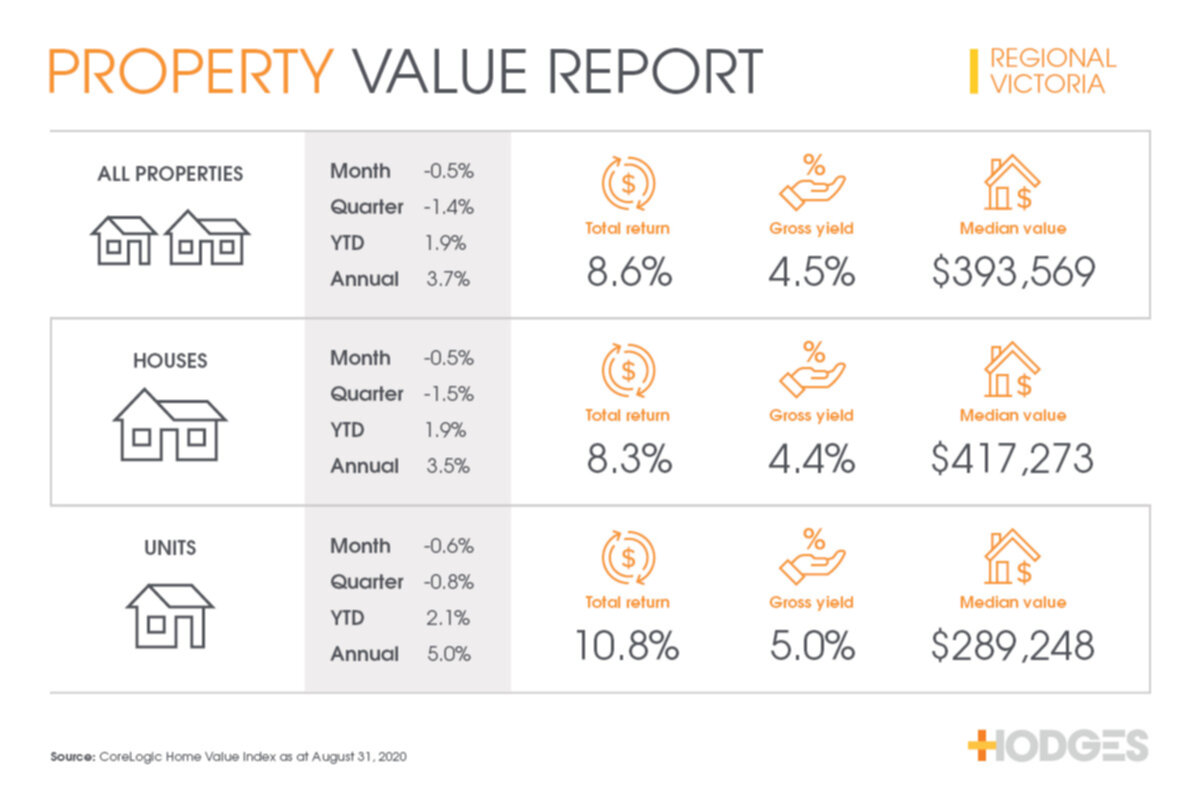

In terms of the impact that the pandemic is having on dwelling values, we’re certainly seeing buyer and seller confidence diminish slightly, as it typically does during periods of uncertainty. Australian house prices recorded their 4th consecutive monthly decline of 0.4% in August. Melbourne experienced the biggest fall throughout the month out of all the capital cities. This highlights the impact that a more predominant viral outbreak has on the real estate industry. It seems the performance of the property market directly correlates with the extent of the Government restrictions in place, which also relate to employment levels, buyer sentiment and economic conditions. We expect property prices to stabilise and improve once restrictions in Melbourne begin to ease.

What’s important to note, is the decline in dwelling values have been mild and orderly and in line with the state lockdowns. Annually, property prices are still up 5.9% in Melbourne and 3.7% in Regional Victoria. We have every confidence that the property market will bounce back and make a full recovery. The Federal Budget will be released on the 6th of October, which will provide more clarity on the timeline of recovery and the direction the property market will take, following a period of economic hardship.

Definitions:

YTD – Year to date (YTD) refers to the period commencing the first day of the current calendar year up to the current date and the percentage (%) change from then until now.

Gross Yield – The “yield” of a property tells you how much of an annual return you are likely to get on your investment. It is calculated by expressing a year’s rental income as a percentage of how much the property cost.

Total Return – is calculated from property value change as well as the gross rental yield. Typically, houses have a superior value growth performance while units offer superior rent returns. You can’t simply sum the Gross Yield and Annual Return figures together to calculate the Total Return, as the Total Return is based on an annualised Gross Yield, which differs from the Gross Yield shown in this graphic (month-end figure).